Did you know Malaysia increase penalties for taxpayers that do not prepare Transfer Pricing Documentation?

Knowledge • Did you know Malaysia increase penalties for taxpayers that do not prepare Transfer Pricing Documentation?

Knowledge • Did you know Malaysia increase penalties for taxpayers that do not prepare Transfer Pricing Documentation?

.jpg)

On 15 December 2019, the Malaysian Inland Revenue Board (“IRB”) issued the updated Tax Audit Frameworks including Transfer Pricing (“TP”) Audit Framework 2019. The updated tax audit frameworks take effect from 15 December 2019.

The 2019 TP Audit Framework introduced several key changes that can impact taxpayers and increase the total value of a transfer pricing adjustment significantly.

The most relevant change relates to the penalty surcharge for taxpayers that do not prepare transfer pricing documentation. If a taxpayer doesn’t prepare transfer pricing documentation and is subject to an audit, the tax authority will impose a penalty of 50% increase on the total transfer pricing adjustment.

For example, a taxpayer is subject to audit and the total value of a transfer pricing adjustment is RM1 million. The adjustment can be increased by 50% (i.e. 500k) if the taxpayer does not have transfer pricing documentation increasing the total adjustment to RM1.5 million.

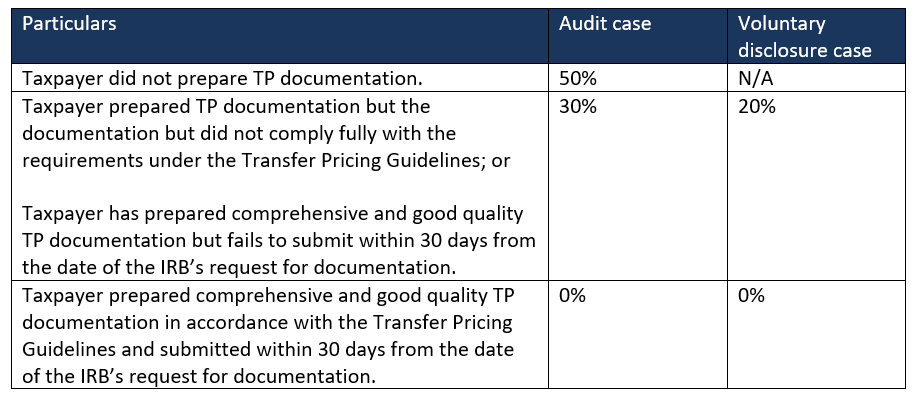

The different penalty rates introduced by 2019 TP Audit Framework are summarised in the table below.

Other changes in the 2019 TP Audit Framework include:

for documentation and information. Previously, the taxpayers are given 21 days to respond to the request.

for documentation and information. Previously, the taxpayers are given 21 days to respond to the request.

Be proactive, and manage your transfer pricing compliance and risks since the beginning to avoid future headaches and high penalties. Transfer Pricing Solutions Malaysia can help with practical and cost-effective solutions for Malaysian companies to prepare Transfer Pricing documentation.

Questions?

Contact Transfer Pricing Solutions Malaysia. We can assist with the preparation of transfer pricing documentation locally and regionally, Master File and Local File to comply with the OECD and also local legislation.

Malaysia

+ 603 2298 7153

services@transferpricingsolutions.my

As global tax reform reshapes the way multinationals manage cross-border transactions, Operational Transfer Pricing (OTP) is rapidly becoming a business-critical priority, especially in the Asia-Pacific (APAC) region.

As global trade becomes more complex, companies are re-examining their supply chains - and transfer pricing is at the heart of that conversation.

In multinational enterprises, it is common for parent companies or group service companies to provide intra group services to related parties. These services are outsourced to the group service provider for business convenience and efficiency reasons.