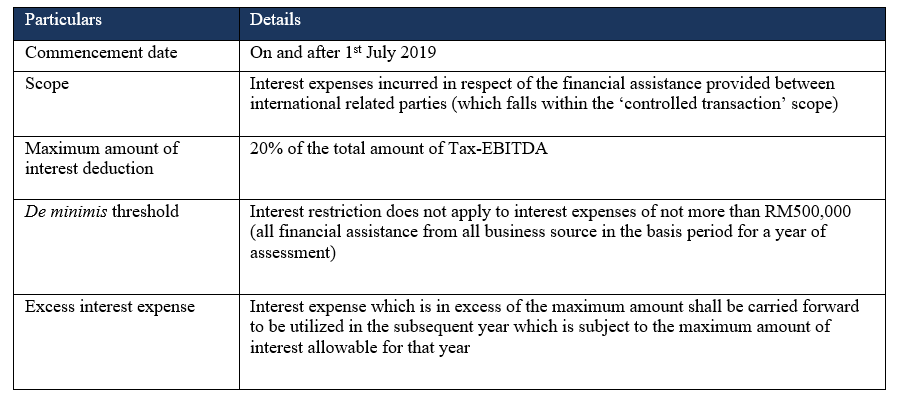

The introduction of Earning Stripping Rules (“ESR”) limiting the interest deduction for financial assistance between related persons were announced in the Budget 2018.

Through the Section 140C, Income Tax Act (“ITA”) 1967, the rules on the interest deductibility has been implemented and gazetted on 28 June 2019. On 5 July 2019, the Malaysian Inland Revenue Board (“MIRB”) released the Guidelines on ‘Restriction on Deductibility of Interest’.

The legislation has been adopted directly from the OECD Base Erosion and Profit Shifting (“BEPS”) Action 4 - ‘Limitation on Interest

Deductions’

aimed to limit base erosion through the use of interest expense to achieve excessive interest deductions or to finance the production of

exempt or deferred income.

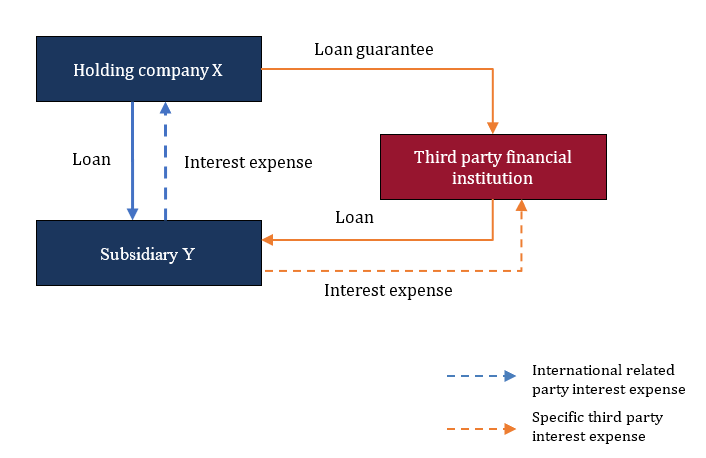

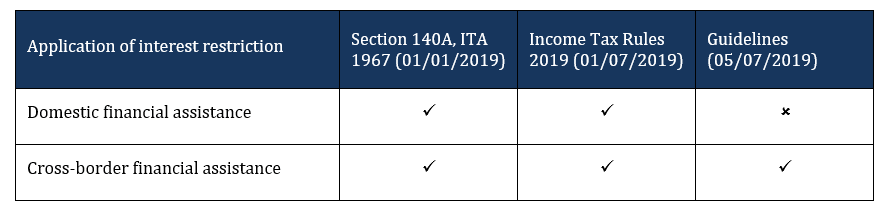

The chart below illustrates the interest expense transactions which fall within the scope of this legislation.

This legislation for restriction on the deductibility of interest is applicable to:

The interest restriction is not applicable to a person where the total amount of any interest expense for all financial assistance from all

business sources is not more than RM500,000 in the basis period for a year of assessment.

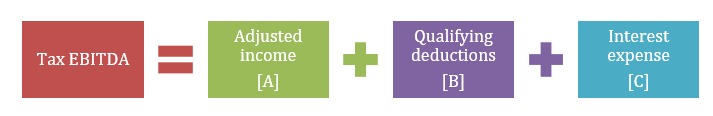

Tax-EBITDA of a person for the basis period for a year of assessment is as follows:

Adjusted income [A]

This is the amount of adjusted income before any restriction on the deductibility of interest is made under section 140C of the Act of that

person from his source consisting of a business for the basis period for a year of assessment.

This is the amount of adjusted income before any restriction on the deductibility of interest is made under section 140C of the Act of that

person from his source consisting of a business for the basis period for a year of assessment.

Qualifying deductions [B]

This is the total amount of qualifying deductions allowed in ascertaining the total amount of the adjusted income before any restriction on

the deductibility of interest is made under section 140C of the Act in [A].

Interest expense [C]

This is the total amount of interest expense incurred in relation to the gross income of a person for financial assistance from business

source for the basis period for a year of assessment.

Others:

Negative Tax-EBITDA will be considered as NIL for the calculation under the Guidelines.

The maximum amount of interest expense referred to in section 140C of the Act shall be an amount equal to 20% of the total amount of the Tax-EBITDA of that person consisting of a business source for the basis period for a year of assessment.

The allowable interest expense is restricted to Fixed Ratio or Interest Expenses, whichever is lower from each of business sources.

Interest expense which is in excess of the maximum amount which is ascertained in the Rules, shall be carried forward to be utilized in the

subsequent year which is subject to the maximum amount of interest allowable for that year.

Interest expense which is in excess of the maximum amount which is ascertained in the Rules, shall be carried forward to be utilized in the

subsequent year which is subject to the maximum amount of interest allowable for that year.

The restriction on deductibility of interest under Section 140C of the Act and the Rules will only be applicable on a business source where

the basis period of a person start on or after 1st

July 2019.

The interest restriction under Section 140C of the ITA and the Rules do not apply to:

There are inconsistencies in relation to the scope in covering the domestic and cross-border related party financial assistance as depicted by Section 140C, ITR 2019 and the Guidelines.

Although the Guidelines do not have force of law, they provide guidance on how Section 140C, ITA1967 and the Rules will be administered and

will be binding on the Director General of Inland Revenue (“DGIR”).

Contact Transfer Pricing Solutions. We can assist with the preparation of transfer pricing documentation locally and regionally, Master File and Local File to comply with the OECD and also local legislation.

Australia

+61 (3) 59117001

reception@transferpricingsolutions.com.au

Singapore

+65 31585806

services@transferpricingsolutions.asia

Malaysia

+ 603 2298 7153

services@transferpricingsolutions.my

As global tax reform reshapes the way multinationals manage cross-border transactions, Operational Transfer Pricing (OTP) is rapidly becoming a business-critical priority, especially in the Asia-Pacific (APAC) region.

As global trade becomes more complex, companies are re-examining their supply chains - and transfer pricing is at the heart of that conversation.

In multinational enterprises, it is common for parent companies or group service companies to provide intra group services to related parties. These services are outsourced to the group service provider for business convenience and efficiency reasons.