The Malaysian Finance Bill 2020 was released following the tabling of the Malaysian 2021 Budget on 6 November 2020. The Finance Bill

2020 incorporates transfer pricing-related changes to the current Income Tax Act, 1967 (“ITA”). The changes permit significantly greater

authority to the Malaysia Inland Revenue Board (“MIRB”) and re-emphasises the importance of TP compliance, with effect from 1 January 2021.

On 21 April 2021 we hosted a webinar on this topic. Take a look:

The key amendments made following the release of the Finance Bill 2020 and gazetted on 31 December 2020 are summarised below:

|

Amendment |

Prior to 1 January 2021 |

Effective 1 January 2021 |

|

Penalty for failure to furnish TP documentation |

No specific provision in the ITA on the imposition of penalty for failure to furnish contemporaneous TP documentation |

A new section 113B in the ITA is proposed to include the penalties for failure to furnish TP documentation to the MIRB on time.

|

|

Surcharge for TP adjustment |

A penalty is imposed on TP adjustments resulting in additional tax payable. The penalty cannot be imposed on businesses with no tax payable (eg. businesses incurring losses) |

|

|

TP documentation to be made available within 14 days upon request |

TP documentation to be submitted within 30 days upon request by the Director General of Inland Revenue ("DGIR"). |

|

|

Tax authority to disregard structures in a controlled transaction |

The provision in relation to power of the DGIR to disregard and make adjustment to any structure adopted by a person for TP purposes can be found under Income Tax (TP) Rules 2012. |

|

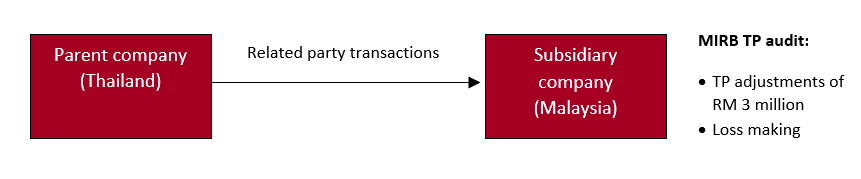

We illustrate below a brief example on how the penalty and surcharge will be imposed on company in Malaysia:

|

Prior to 1 January 2021 |

Effective 1 January 2021 |

|

A penalty or surcharge cannot be imposed as the company is loss making |

Section 140A(3C) – Surcharge of up to 5% (i.e. RM150,000) |

|

Section 113B(4) – Penalty between RM20,000 to RM100,000 |

Transfer pricing awareness in Malaysia has been increasing since the introduction of the Malaysian Transfer Pricing Guidelines 2012 coupled with the introduction of a transfer pricing declaration in the corporate tax return in 2014.

The lack of clear penalties as well as the Malaysian Transfer Pricing Guidelines 2012 allowed the SMEs to go under the radar as SMEs deemed the transfer pricing compliance was not necessary.

With the introduction of the fixed penalty as well as shorten timeline to furnish the TP documentation upon request, SMEs that have not prepared any TP documentation are effectively caught under this regime which will force the SMEs to be compliant.

Be proactive, and manage your TP compliance and risks since the beginning to avoid future headaches and high penalties. TP Solutions

Malaysia can help with practical and cost-effective solutions for Malaysian companies to prepare TP documentation.

Transfer Pricing Solutions Malaysia can assist with the preparation of TP documentation locally and regionally, Master File and Local File to comply with the OECD and also local legislation.

Malaysia

+ 603 2298 7153

services@transferpricingsolutions.my

www.transferpricingsolutions.my/

As global tax reform reshapes the way multinationals manage cross-border transactions, Operational Transfer Pricing (OTP) is rapidly becoming a business-critical priority, especially in the Asia-Pacific (APAC) region.

As global trade becomes more complex, companies are re-examining their supply chains - and transfer pricing is at the heart of that conversation.

In multinational enterprises, it is common for parent companies or group service companies to provide intra group services to related parties. These services are outsourced to the group service provider for business convenience and efficiency reasons.