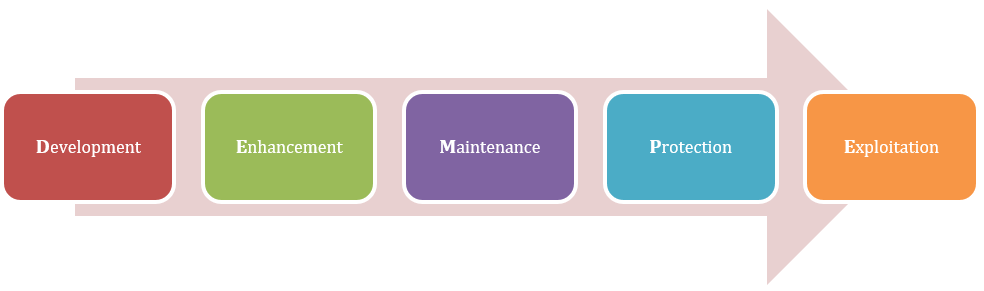

Overview of Development, Enhancement, Maintenance, Protection and Exploitation (DEMPE) analysis

Knowledge • Overview of Development, Enhancement, Maintenance, Protection and Exploitation (DEMPE) analysis

Knowledge • Overview of Development, Enhancement, Maintenance, Protection and Exploitation (DEMPE) analysis

Digital transformation has contributed significant changes to the world, changing the nature of the business and the industry value chain,

even the way people interact with each other. Intangible Properties ("IPs") have become the main driver of business profits within

Multinational Enterprises ("MNEs") especially in the digital economy ecosystem. With the increasing complexity of IPs and myriad

Transfer Pricing cases surrounding the exploitation of IPs, DEMPE analysis was introduced to tackle this issue.

It assists MNEs to allocate their return and costs appropriately based on the value creation by each entity. DEMPE was first introduced in

the final Actions 8 – 10 of the Organisation for Economic Co-operation and Development ("OECD") Base Erosion and Profit Shifting

("BEPS") projects in October 2015. The recommendations of Actions 8 – 10 have been instrumental in addressing the complexity of IP

in respect of Transfer Pricing.

Why Was DEMPE Introduced?

In the past, all the income were inured to the legal owner even though the party may not demonstrate substantive functions related to the IP.

Hence, DEMPE was introduced as a qualitative tool in assisting the functional analysis conducted in relation to the IP, to ultimately price

the transaction. With this new model, the legal owner of the IP may not be entitled to receive all the returns generated for the Group just

because it is the legal owner. Instead, it should be allocated based on contribution by each entity to the IP value. This deters the cash

rich but minimally functioning entity, known as ‘cash box’ operating in a low tax jurisdiction to avoid tax.

Hence, DEMPE was introduced as a qualitative tool in assisting the functional analysis conducted in relation to the IP, to ultimately price

the transaction. With this new model, the legal owner of the IP may not be entitled to receive all the returns generated for the Group just

because it is the legal owner. Instead, it should be allocated based on contribution by each entity to the IP value. This deters the cash

rich but minimally functioning entity, known as ‘cash box’ operating in a low tax jurisdiction to avoid tax.

Hence, the topic for the Actions 8 – 10 BEPS report was named as ‘Aligning Transfer Pricing Outcomes with Value Creation’.

Questions to Ask When Conducting DEMPE

1. What is the IP in your Group?

2. Delineation of the transactions through:

3. How was the value of the IP created?

4. What are the associated risks and who bears and control the risks?

Keep in mind:

IP ownership and contractual terms relating to intangibles could indicate the legal owner of the IP but not necessarily the economic owner.

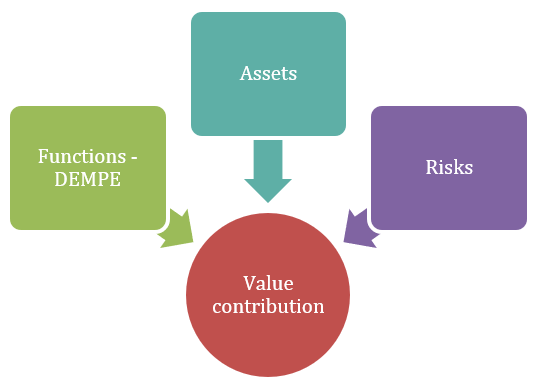

The purpose is to ensure all members of the Group are appropriately compensated for the functions they perform, the assets they contribute

and the risks they assume related to the DEMPE of the intangible.

Decision making or functions that relate to the DEMPE of the IP is a good indicator of the weightage of IP related profits to be allocated to each party.

The next step involves the selection of the most appropriate TP method involving the transfer of intangibles.

Keep in mind:

The entity that provides funding, bears or controls the associated risk are the indicators of the level of contribution.

The selection of the most appropriate TP method should be based on a functional analysis that provides a clear understanding of the MNE’s global business processes and how the transfer of IP would have an impact on the business.

Although the 2017 OECD Guidelines mentioned that the any one of the five transfer pricing methods could be selected and applied based on

the facts and circumstances. Nevertheless, the Guidelines mentioned that there are situations where the Profit Split Method (two-sided

method) would be more appropriate than others one-sided method.

In China, the State Administration of Taxation (“SAT”) introduced DEMPEP with an additional “P” as promotion. This indicates that

the tax authority of China emphasizes a lot on the value created by the marketing activities by MNCs in China.

In China, the State Administration of Taxation (“SAT”) introduced DEMPEP with an additional “P” as promotion. This indicates that

the tax authority of China emphasizes a lot on the value created by the marketing activities by MNCs in China.

Companies that do not align their DEMPE functions with IP ownership are encouraged to assess their current transfer pricing structures and determine whether any remedial action is required.

Contact Transfer Pricing Solutions. We can assist with the preparation of cost effective transfer pricing documentation locally and regionally, transfer pricing planning, and Country-by-Country reporting statements.

Australia

+61 (3) 59117001

reception@transferpricingsolutions.com.au

Singapore

+65 31585806

services@transferpricingsolutions.asia

Malaysia

+ 603 2298 7153

services@transferpricingsolutions.my

As global tax reform reshapes the way multinationals manage cross-border transactions, Operational Transfer Pricing (OTP) is rapidly becoming a business-critical priority, especially in the Asia-Pacific (APAC) region.

As global trade becomes more complex, companies are re-examining their supply chains - and transfer pricing is at the heart of that conversation.

In multinational enterprises, it is common for parent companies or group service companies to provide intra group services to related parties. These services are outsourced to the group service provider for business convenience and efficiency reasons.