Transfer Pricing Solutions Malaysia is winner to ITR Tax Awards 2019

Knowledge • Transfer Pricing Solutions Malaysia is winner to ITR Tax Awards 2019

Knowledge • Transfer Pricing Solutions Malaysia is winner to ITR Tax Awards 2019

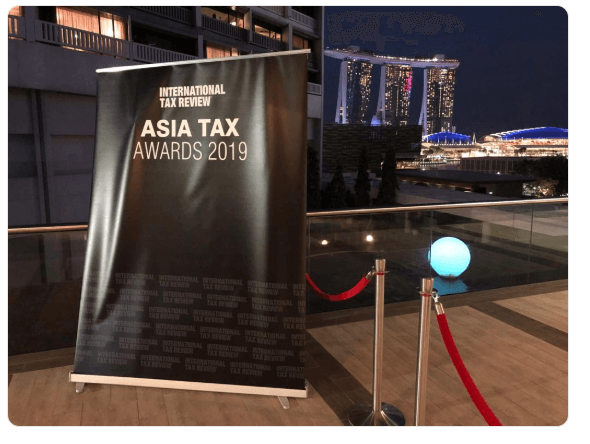

We are so proud to deliver you the good news! Our Malaysian office, Transfer Pricing Solutions Malaysia won the prestigious Asia

Best

Newcomer

of the Year

award at the International Tax Review (ITR) Asia Tax Awards 2019.

We had a wonderful time at the awards, and we were glad to be part of the event. Congratulations to all the winners! Click here for more details on the full list of the winners.

Transfer Pricing Solutions was shortlisted as a finalist for the following nominations:

Read more about the nominations in our blog:

https://www.transferpricingsolutions.my/knowledge/transfer-pricing-solutions-malaysia-is-finalist-to-itr-tax-awards-2019/

We would like to address our team’s great effort that has led us to these nominations and winning. Our dedicated team bring energy, fresh

ideas and pride to their work. The diversity in our team is what keeps us thriving for more and going that extra mile in providing the most

ideal transfer pricing solutions to our clients.

"Great things in business are not done by one person. They are done by a team of people"

Transfer Pricing Solutions Malaysia assists clients in the planning and preparation of transfer pricing documentation, country by country

(CbC) reporting, comprehensive transfer pricing policy; performing local benchmarking comparable searches, providing training designed for

CFOs and tax teams and performing transfer pricing controversy and audits. We cater to multinational enterprises with the help of our

global offices, Small & Medium size enterprises (SMEs) and accounting and law firms.

Transfer Pricing Solutions Malaysia assists clients in the planning and preparation of transfer pricing documentation, country by country

(CbC) reporting, comprehensive transfer pricing policy; performing local benchmarking comparable searches, providing training designed for

CFOs and tax teams and performing transfer pricing controversy and audits. We cater to multinational enterprises with the help of our

global offices, Small & Medium size enterprises (SMEs) and accounting and law firms.

Get to know more about our firm and our people by visiting our website https://www.transferpricingsolutions.my or email us at services@transferpricingsolutions.my.

As global tax reform reshapes the way multinationals manage cross-border transactions, Operational Transfer Pricing (OTP) is rapidly becoming a business-critical priority, especially in the Asia-Pacific (APAC) region.

As global trade becomes more complex, companies are re-examining their supply chains - and transfer pricing is at the heart of that conversation.

In multinational enterprises, it is common for parent companies or group service companies to provide intra group services to related parties. These services are outsourced to the group service provider for business convenience and efficiency reasons.